Home Equity Loans vs. Equity Loans: Comprehending the Distinctions

Home Equity Loans vs. Equity Loans: Comprehending the Distinctions

Blog Article

Maximize Your Properties With a Strategic Home Equity Financing Plan

One such avenue that has amassed interest is the usage of home equity via an attentively crafted funding plan. As we navigate the elaborate landscape of home equity car loans, the importance of cautious preparation and foresight comes to be increasingly apparent.

Understanding Home Equity Car Loans

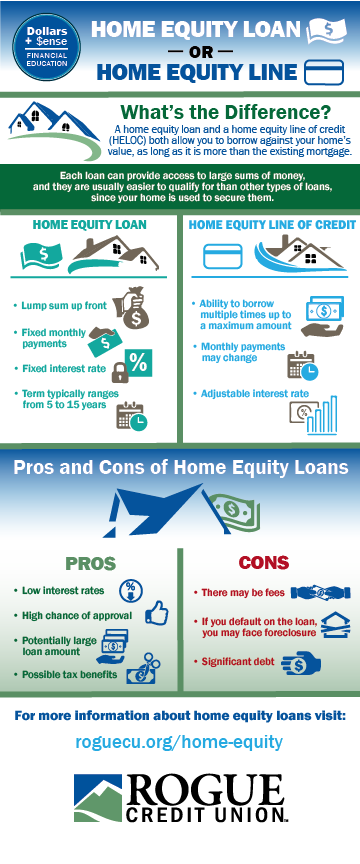

An extensive understanding of the details bordering home equity financings is basic for educated financial decision-making. Home equity fundings allow home owners to take advantage of the equity developed in their residential or commercial property to access funds for numerous purposes. One essential element to comprehend is that these fundings are protected by the worth of the home itself, making them less risky for lenders and typically resulting in reduced rate of interest for borrowers compared to unprotected loans.

Moreover, understanding the loan-to-value proportion, repayment terms, potential tax implications, and the risks entailed in using your home as collateral are critical parts of making audio financial decisions regarding home equity financings. By acquiring a thorough understanding of these facets, homeowners can use home equity finances tactically to achieve their monetary objectives.

Advantages of Leveraging Home Equity

When tactically leveraged,Making use of the equity in your home can supply an array of economic benefits. Alpine Credits Home Equity Loans. One of the main benefits of leveraging home equity is accessibility to huge amounts of cash at reasonably low rate of interest contrasted to various other types of loaning. By utilizing your home as security, lenders are a lot more going to use desirable terms, making home equity fundings an appealing option for funding significant costs such as home remodellings, education and learning prices, or debt consolidation

In addition, the rate of interest paid on home equity financings is commonly tax-deductible, giving potential cost savings for house owners. This tax advantage can make leveraging home equity even much more affordable compared to various other kinds of financings. Additionally, home equity car loans typically provide much longer settlement terms than personal fundings or bank card, permitting more convenient monthly repayments.

Moreover, by reinvesting borrowed funds into home enhancements, house owners can possibly boost the value of their residential or commercial property. This can cause a higher resale worth or enhanced living problems, additionally improving the economic benefits of leveraging home equity. On the whole, leveraging home equity intelligently can be a critical economic move with different benefits for homeowners.

Strategic Planning for Funding Utilization

Having established the advantages of leveraging home equity, the following important action is purposefully preparing for the application of the loan earnings - Equity Loans. When considering just how to best utilize the funds from a home equity finance, it is crucial to have a clear strategy in position to take full advantage of the benefits and guarantee economic security

One critical strategy is to utilize the finance earnings for home enhancements that will increase the property's value. Improvements such as cooking area upgrades, shower room remodels, or including added home can not only improve your everyday living experience however additionally boost the resale worth of your home.

One more sensible use of home equity funding funds is to consolidate high-interest financial debt. By paying off bank card, individual fundings, or other financial obligations with reduced rates of interest profits from a home equity financing, you can conserve money on rate of interest repayments and simplify your financial resources.

Last but not least, purchasing education and learning or funding a major cost like a wedding event or clinical costs can additionally be strategic uses home equity loan funds. By meticulously intending how to designate the proceeds, you can leverage your home equity to attain your economic objectives properly.

Factors To Consider and threats to Remember

Thinking about the possible pitfalls and factors to take into consideration is important when considering the usage of a home equity finance. One of the key threats connected with a home equity financing is the possibility of back-pedaling payments. Since the financing is safeguarded by your home, failing to settle might cause the loss of your residential or commercial property via foreclosure. It's vital to assess your monetary security and ensure that you can pleasantly handle the extra financial obligation.

An additional factor to consider is the rising and official source falling nature of rates of interest (Home Equity Loan) (Alpine Credits Home Equity Loans). Home equity financings typically feature variable rate of interest, indicating your month-to-month settlements can enhance if rates of interest rise. This possible boost ought to be factored right into your economic preparation to avoid any kind of shocks down the line

Additionally, beware of overborrowing. While it may be alluring to access a large amount of cash via a home equity financing, just borrow what you genuinely need and can manage to pay back. Cautious factor to consider and prudent financial monitoring are vital to efficiently leveraging a home equity funding without falling right into monetary troubles.

Tips for Effective Home Equity Finance Administration

When navigating the world of home equity lendings, prudent financial management is vital for maximizing the benefits and minimizing the connected risks. To successfully handle a home equity funding, begin by developing a comprehensive budget that details your month-to-month income, expenditures, and car loan payment responsibilities. It is vital to prioritize timely settlements to prevent charges and maintain a good credit history.

On a regular basis checking your home's value and the equity you have actually developed can assist you make informed choices concerning leveraging your equity better or adjusting your repayment method - Home Equity Loan. Furthermore, consider establishing automated settlements to make certain that you never miss out on a due day, therefore safeguarding your economic standing

Another suggestion for effective home equity finance management is to explore possibilities for re-financing if rates of interest go down dramatically or if your credit rating improves. Refinancing might potentially lower your month-to-month payments or permit you to settle the funding faster, conserving you money over time. By adhering to these strategies and staying positive in your monetary preparation, you can successfully handle your home equity finance and maximize this valuable financial device.

Verdict

Finally, strategic planning is crucial when making use of a home equity loan to make the most of properties. Understanding the risks and advantages, as well as carefully considering how the funds will be used, can assist guarantee successful monitoring of the lending. By leveraging home equity intelligently, people can make the many of their assets and achieve their financial objectives.

Home equity loans allow home owners to leverage the equity constructed up in their residential property to access funds for various objectives. By using your home as collateral, lending institutions are extra ready to supply favorable terms, making home equity finances an attractive option for financing major costs such as home improvements, education prices, or debt consolidation.

In addition, home equity finances commonly offer much longer repayment terms than personal loans or credit cards, enabling for more workable month-to-month repayments.

Careful factor to consider and prudent monetary monitoring are key to effectively leveraging a home equity financing without dropping into financial troubles.

To successfully handle a home equity car loan, begin by producing an in-depth spending plan that details your month-to-month income, costs, and lending repayment commitments.

Report this page